I'm John Harmon. I'm the owner of a small CPA firm here in McKinney, Texas, which is a suburb of Dallas. I want to show you how I use estimates. I've been using the CERT program for 20 years and have found some shortcuts that can save you time. It has always saved me time to generate estimates quickly. So let's get started. One of the issues we face as preparers is getting the estimates to print exactly how we want them to be. I have four typical classes of clients that come into my firm regarding estimates. The first class does not want any estimates, no matter what they should pay. To satisfy them, all I have to do is put a 1 in the screen for 2010 estimated tax. By putting in a -1, it means no estimates here. Instead of looking at the individual objects, I look at the letter, which shows all four payments at the same time. For the second class, they want to pay a certain amount, usually the same as last year. The third class does not know how much extra they have to pay. The fourth class wants the program to determine what they should be paying, and they might need some adjustments, but they want the program to do the work for them. These clients usually come around April 15th and want to be even or close to even, or possibly receive a refund. Let's start with the first client who does not want any estimates. It's easiest for me to satisfy them. I just need to put a 1 in the screen for 2010 estimated tax. By doing this, no estimates are generated. It's important to see what the estimates will be by looking at the letter instead of the individual objects....

Award-winning PDF software

Il 1040 Es Form: What You Should Know

Please be aware that a state income tax preparer who uses the 2025 Form IL-1040-ES to estimate your net taxable income may result in a payment amount that is too high. Note that Form IL-1040-ES will not be used if your net taxable income is less than 10,000.00 or less than 10% of your adjusted gross income. To see a sample 2025 Illinois Form IL-1040-ES and 2025 Illinois Form IL-1040-ESS, please click on the link above. You need a valid Illinois taxpayer identification number, such as I-551, Social Welfare card, or I-129W. Form IL-1040-ES is provided under Section 16 of the Illinois Income Tax Act. Please also be aware that the IRS publishes IRS Income Tax Filing Calendar for 2017, which includes dates for filing with your Illinois state tax return. You also need a valid Illinois taxpayer identification number, such as I-551 Social Welfare card, or I-129W. Form IL-1040-ES is provided under Section 16 of the Illinois Income Tax Act. PLEASE NOTE: If you make a payment in error, contact us at 1-800-IL-S-TAXES to report the error. Please call us prior to filing an Illinois Individual Income Tax Return, to make sure the tax form is accurate in all respect. Form IL-1040-ES is not considered a request for verification of income, filing status, exemption amount, or any other item on Form I-9 or Form 1040-EZ. Illinois Income tax law requires taxpayers to complete all forms required to claim or repay taxes. An Individual Income Tax Return for Individuals and the Form IL-1040-ES are completed with the help or support of an Illinois Tax Exempt Organizations (TO). If you are unable to use an TO or if you are tired of using an TO, you may file a Form I-864, Application for IRS Certification of Estate of Trust as Trustee, with the Illinois Department of Revenue. Form I-864 is a written petition requesting permission to be called an Estate Trustee.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-ES, steer clear of blunders along with furnish it in a timely manner:

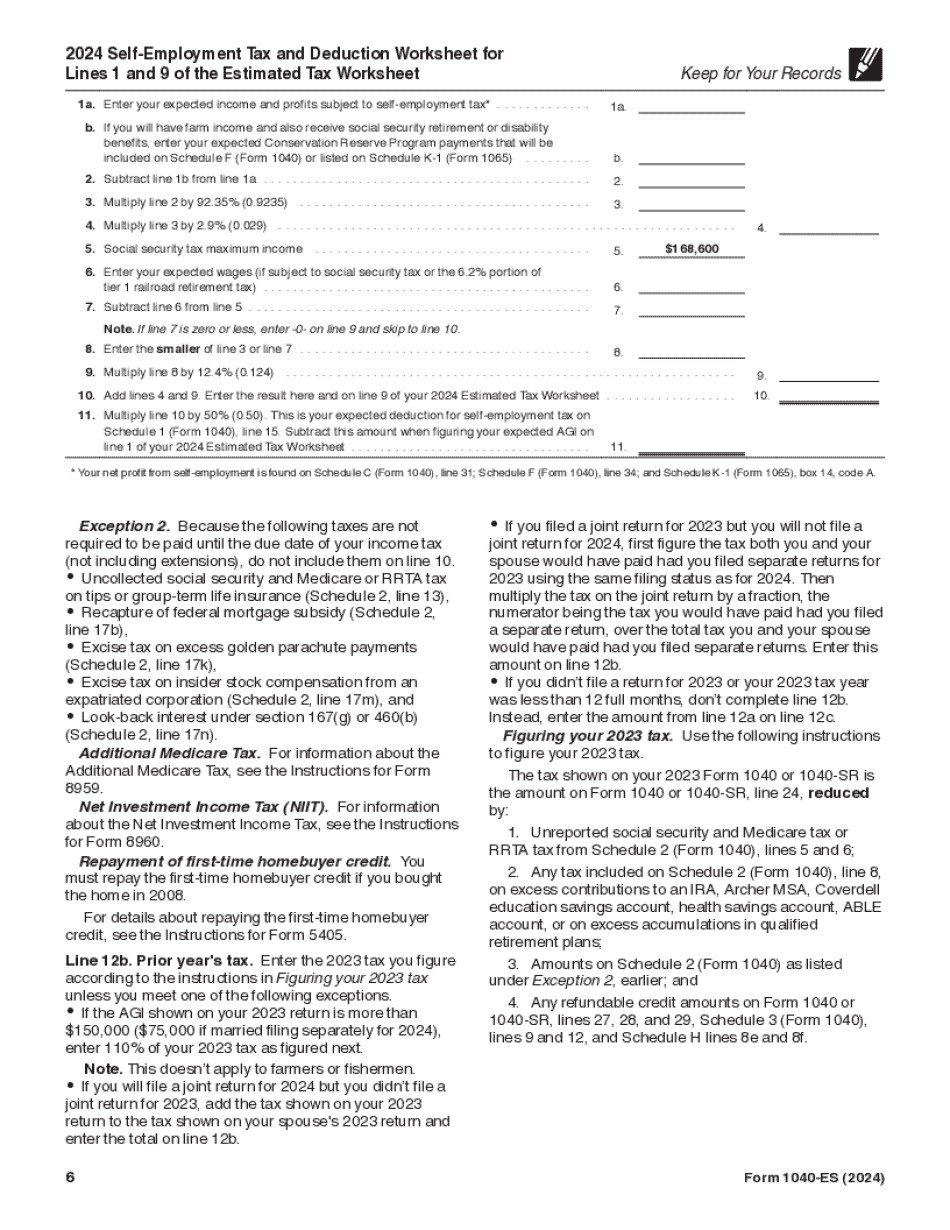

How to complete any Form 1040-ES online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-ES by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-ES from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Il 1040 Es