Hey guys, Anthony Fontana here. I'm an IRS enrolled agent with EI Tax Resolutions. Today, I'm answering a question that I often receive from newly self-employed individuals who are wondering what to do for taxes. Self-employment income taxes can be a little bit tricky, but they're not too bad. There are a few things we need to know: First, we need to know when to make the payments. The IRS operates on a pay-as-you-go system, just like when you're employed and taxes are taken out of each paycheck. If you own a business or are self-employed, you'll have to make these payments throughout the year. You can't wait until the end of the year to pay all your taxes because you'll be hit with penalties. The IRS wants their money as you earn the income. With that being said, you have to make your tax payments every quarter. The IRS states that these quarterly payments are due on the 15th of April, June, September, and January of the following year. Now, let's move on to how much you have to pay each quarter. The IRS says you have to pay either 100% of your last year's tax liability or 90% of your current estimated tax liability. To simplify, let's say your tax liability last year was $12,000. You would then need to split that $12,000 into four payments since we have to make quarterly payments. That means you have to make a $3,000 payment each quarter. Lastly, let's discuss how to make these payments. Luckily, I made a video on how to pay the IRS, and I'll include a link in the description below for your convenience. In summary, when it comes to self-employment income taxes: 1. You have to make quarterly payments on the 15th of April, June, September,...

Award-winning PDF software

Estimated tax payments 2025 Form: What You Should Know

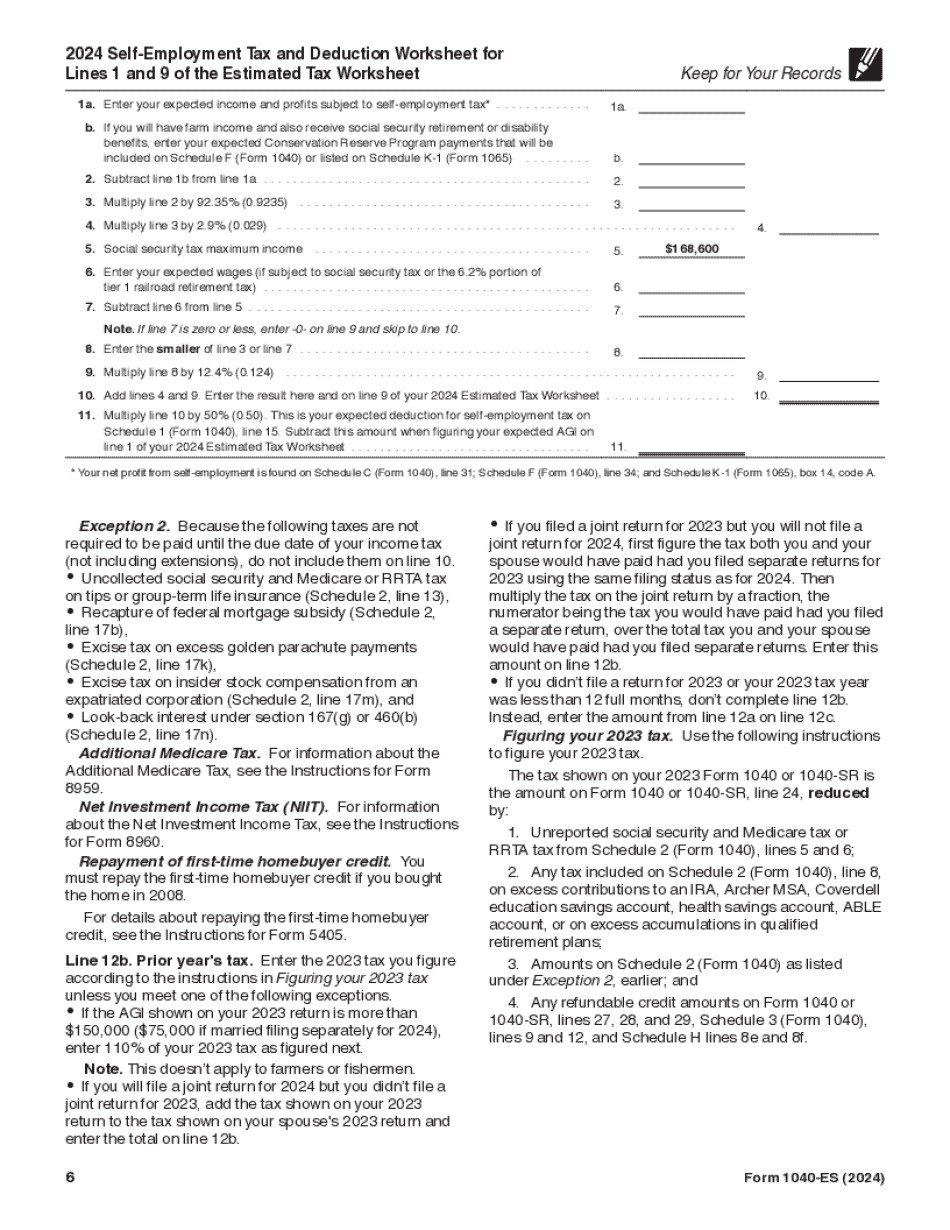

Payment of Estimated Tax The form you used to pay the estimated tax is usually Form 1040-ES for married filing jointly, Form 1040NR for non-resident aliens, Form 540-ES for non-resident aliens, or the form you will use if you decide to file. Form 1040-ES-NR for non-resident aliens If non-resident aliens qualify for the Earned Income Tax Credit (ETC), use the form 1040-ES-NR to figure and pay your estimated tax for 2019. For more information, see: Form 1040NR-NR Nonresident Alien You may have to make an online payment to make Form 540-ES payments for 2019. Enter any income that might be considered as wages in the “Note to Applicant” box on Form 540-ES.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-ES, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040-ES online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-ES by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-ES from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Estimated tax payments 2025