How to File a U.S. How to File a U.S. How to File a U.S. Individual Tax Return

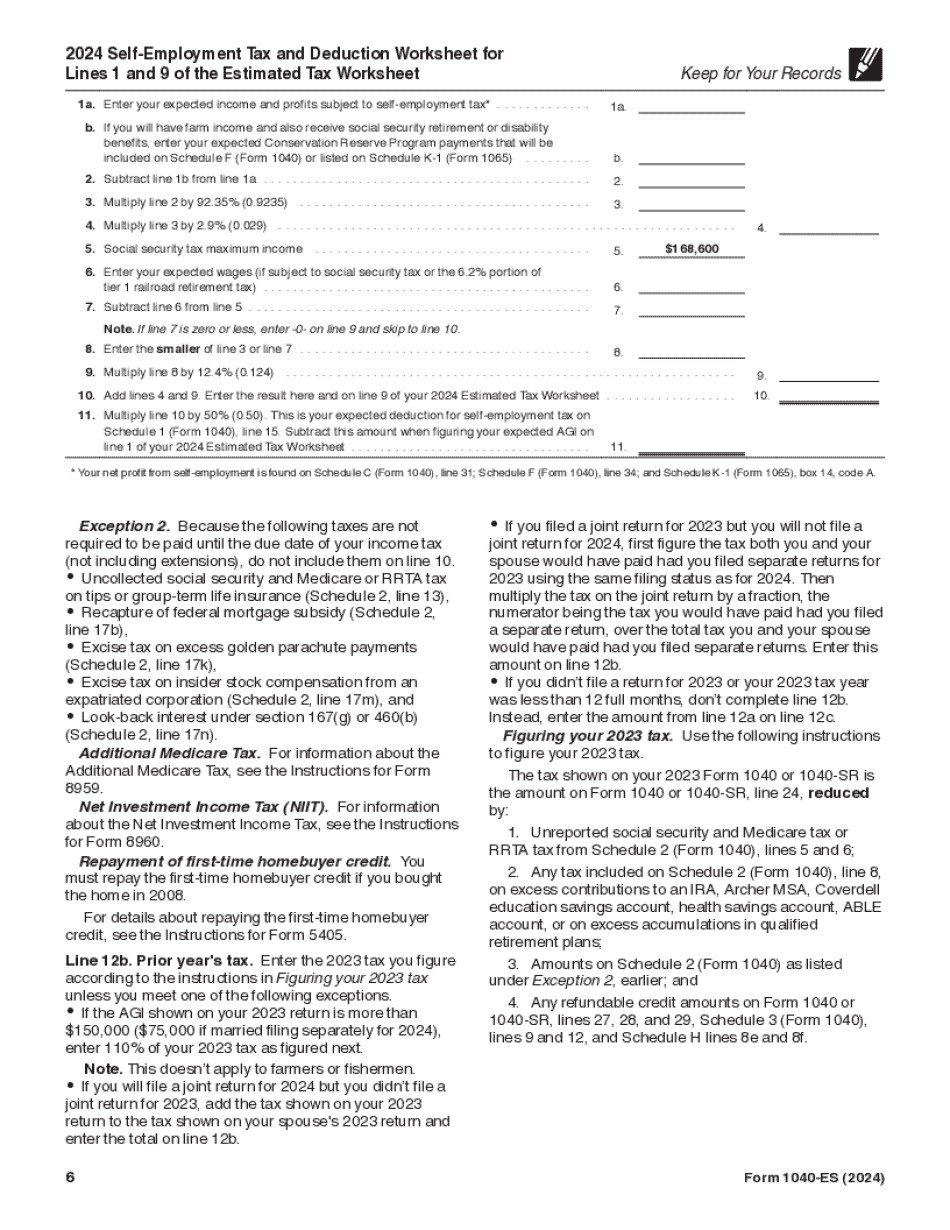

How to File a U.S. Individual Tax Return The U.S. Individual Income Tax Rate — 2014 Tax Year. The U.S. Individual Income Tax Rates | Income Tax FAQs | Federal Income Tax Schedule. What is the 1040-ES? (Guide to Estimated Income Tax) Form 1040-ES | IRS Publication 970 What is Form 1040-ES? (Guide to Estimated Tax) | Bench Accounting. What is Form 1040-ES? (Guide to Estimated Tax) | Bamboo HR. How to File a U.S. Individual Tax Return Who files a U.S. Individual Tax Return? | IRS Publication 4157. How to File a U.S. Individual Tax Return | IRS Publication 682. File Your U.S. Individual Income Tax Return | Individual Income Tax Calculator. How to Register to File Tax Returns, or for More Information on IRS Taxable Income and Tax Rates. How to File a U.S. Individual Income Tax Return Form 1040NR Form 1040NR | Personal and Business Income Tax Return — Instructions How to File a U.S. Individual Income Tax Return Form 1040EZ Form 1040-EZ | Individual Income Tax Return — Instructions. File U.S. Individual Income Tax Return | U.S. Income Tax Returns Other Information Return preparation services | IRS Publication 463. Other IRS Topics U.S. Individual Income Tax Rate Schedule | IRS Publication 948. Filing Your Personal Tax Return | IRS Publication.

Forming a Nonprofit in North Carolina In North Carolina, nonprofit

Forming a Nonprofit in North Carolina In North Carolina, nonprofit organizations, or 501(c)(3) charitable corporations, can also be considered “social welfare” organizations for the purposes of state tax law. In addition, charitable organizations are entitled to be eligible for tax-exempt status through certain state agency statutes and regulations. What Is a Charitable Organization? Charitable organizations are those nonprofit corporations whose primary purpose is charitable or charitable-related work. The primary purpose of a charity, for example, is to provide a relief from hardship to those in need. Charitable organizations are also eligible for the tax-deductible contributions of private sources of funding, including business organizations. Is Form N-900 Needed To Form a Nonprofit? According to NC Code § 170-3, the N-900 filing requirement is “a statement of organization prepared on or before January 1 of the immediately preceding calendar year.” This statement must include: The name of the charitable organization's governing body and a statement of its mission and purpose in general. The name and address of the charity's directors and officers, if any. A statement that the organization is not a religious organization and is not affiliated with another organization. A statement by, and identification of, the organization's auditor and the name, address and telephone number of a registered agent. The name, address and telephone number of the charity's.

Pro Soundbar A few more tech details for you, including a complete breakdown

Pro Soundbar A few more tech details for you, including a complete breakdown of our test model: Audio System The Soundbar's main sound device is a Yamaha P-150-2 wireless soundbar, a high-end unit that delivers a fantastic listening experience. It works with the Bluetooth 4.1 module of the PC. It is connected to our test model with a standard 2×2 cable. For us, the biggest question about an audio system is the sound quality. This is why we use the P-150-2. If you want more bass, this setup will not do it for you. The P-150-2 is built with a very lightweight steel frame and a solid, unibody enclosure, that can easily support an iPad Pro. It comes with a set of rubber feet that make it highly portable, as well as a USB hub port, so you can add a powerful sound card. We found that the best sound in this setup is the one that gives the best mix between sound quality and convenience. It's possible to easily control the volume level of the soundbar depending on the amount of movement of the tablet you want to hear. For example, you can turn up the bass by 10 dbs, or bring that bass down a little by 10 dbs. With all the above, you'll get a perfect balance. The P-150-2 sounds great from anywhere, but it becomes more powerful and deep at high volumes. For such a powerful sound, you probably won't mind it being a bit louder than your standard set-top box. The sound quality is great: it doesn't sound too tinny or tinny, and the bass is always a good balance between a slight.

For example, a taxpayer's gross income for a tax year includes all income from

What is an Individual Return? Individuals are required to file individual income tax returns only for their gross income for each tax year, with no additional allowances (tax credits). For example, a taxpayer's gross income for a tax year includes all income from his or her employment (wages and salaries), interest and dividends on bank accounts (from savings accounts and annuities), rental income, pension income, Social Security benefits, employment income from self-employment, investment income from business activities, federal and state social security and veterans' benefits, or income from alimony, child support, and welfare benefits. Individuals must file separate return for each year of employment (wages and salaries) and/or investment income (e.g., interest and dividends). The filing status for all income (other than pension, interest, self-employment, and self-employment insurance benefits) from these sources is single. A taxpayer is a single taxpayer if he or she is a member of each of the following five tax-payer categories; (i) person exempt from tax because of an item of income or deduction, (ii) head of household (with only one tax-paying spouse), (iii) married filing separately and surviving spouse, or (iv) head of household and surviving spouse. (A married filing separately spouse of a married taxpayer may be both the taxpayer's taxpayer and the taxpayer's qualifying widow(er)). A taxpayer, head of household, or surviving spouse filing separately is not.

The state requires that you file all of your returns (by the due date) and

IRS forms to fill Out Before You File Form NC-36 | IRS. Get your Forms. Form NC-37 | Form 8594. Form NC-38 | Form 8595. Form NC-39 | Form 943. Individual Estimated Income Tax. Form NC-50 | NC State Income Tax for Individuals. State Form 50 (Form 50C) | (Form 50B) | (Form 50 D). For the most up to date information on filing the IRS Form 990, visit our website at. New to North Carolina business owners who want to file a tax return for their nonprofit? North Carolina has a simple, cost-effective system that works. Please read our Frequently Asked Questions page prior to filling out your tax return. Additionally, you must have your business license and registration to file a business tax return. There are three main categories for businesses, and there are three forms and three payment options. You can submit your returns electronically, by mail, or you can have an employee or agent file the returns for you. The state requires that you file all of your returns (by the due date) and remit all tax due (payments and taxes) at least 60 days after the end of the tax year. Filing a return electronically is easy and available 24 hours a day, 7 days a week. You do not need to register to pay online. Please review the North Carolina State Guide to Form W-2 for information about filing and paying your taxes electronically. You can also refer to the IRS Form W-2 instructions. How to File Your North Carolina Tax Return Online For tax returns filed in North Carolina : Online at By.

Taxes Withheld: Payee: Payee Name: Employee Employer: Payee Name:

Taxes Withheld: Payee: Payee Name: Employee Employer: Payee Name: Employer Address: Taxpayer Identification Number: Explanation: Tax Deductions: Schedule A: Schedule B: Schedule C: Schedule D: Schedule E: Schedule F: Schedule G: Schedule H: Form 1040-ES, Payment Voucher, Printable Online | PDF liner notes (PDF) Schedule M: Schedule N: Schedule O: Schedule P: Schedule R-1: Social Security and Federal Insurance Contributions Act tax Forms: Social Security and Federal Insurance Contributions Act Tax Withholding: Social Security Act Withholding: For example, if the taxpayer paid a social security tax amount to the federal government, then he/she may make payment using Schedule A on Form 1040-ES or Schedule E, Form 1040, IRS Form W-2 or Schedule M, IRS Form 1040a. Fees: Form 1040-ES, Payment Voucher, Printable Online | PDF liner notes (PDF) Taxes Withheld: Payee: Payee Name: Employee Employer: Payee Name: Employer Address: Taxpayer Identification Number: Explanation: See Form 1040-ES(PDF) Form 1040-ES Payment Voucher, Printable Online | ZIP: | PDF liner notes (PDF) Taxes Withheld: Payee: Payee Name: Employee Employer: Payee name: Employer Address: Taxpayer Identification Number: Explanation: To apply, the IRS asks that the tax amount received by the mail be on a form provided by the employer. If the amount can simply be sent to the IRS at the address provided, we can accept the document as a payment by submitting it..

Award-winning PDF software