Greetings, my name is Joe Bellavia. I'm an adjunct instructor at San Diego Mesa College. Tonight, we're going to review chapter 3 of the 2015 edition of "Income Tax Fundamentals" by Wittenberg. In this chapter, we will cover learning objective 3.1, which is to complete a basic Schedule C for a sole proprietor's business. As you may recall, individuals are taxable entities, and when an individual owns and operates a business as a sole proprietor, they will include a Schedule C as part of their Form 1040. Let's take a look at the following slides. First, we have the gross receipts or sales, which amount to $35,000. After deducting expenses of $8,650, we have a net profit or loss of $26,350. This net profit or loss is reported on Schedule C. Now, let's review the top half of Schedule C. Pay close attention to the questions asked here. We note that it is a cash method of accounting and that the individual materially participated in the business. We will discuss these two items in later chapters. Next, we consider whether the individual made any payments that require them to file Form 1099. In our example, we answer that question affirmatively as the individual paid rent. Usually, your landlord will need a 1099. Moving on to the bottom half of Schedule C, we see the list of expenses. In our example, rent is $1,100, which is what I was referring to earlier regarding the 1099. Finally, on line 31, we have the net profit or loss from Schedule C, which gets carried over to page 1 of Form 1040. Now, let's determine whether these deductions are for AGI or from AGI. The net profit from Schedule C is reported on line 12 of page 1 of Form 1040. Great job! The taxpayer was allowed an...

Award-winning PDF software

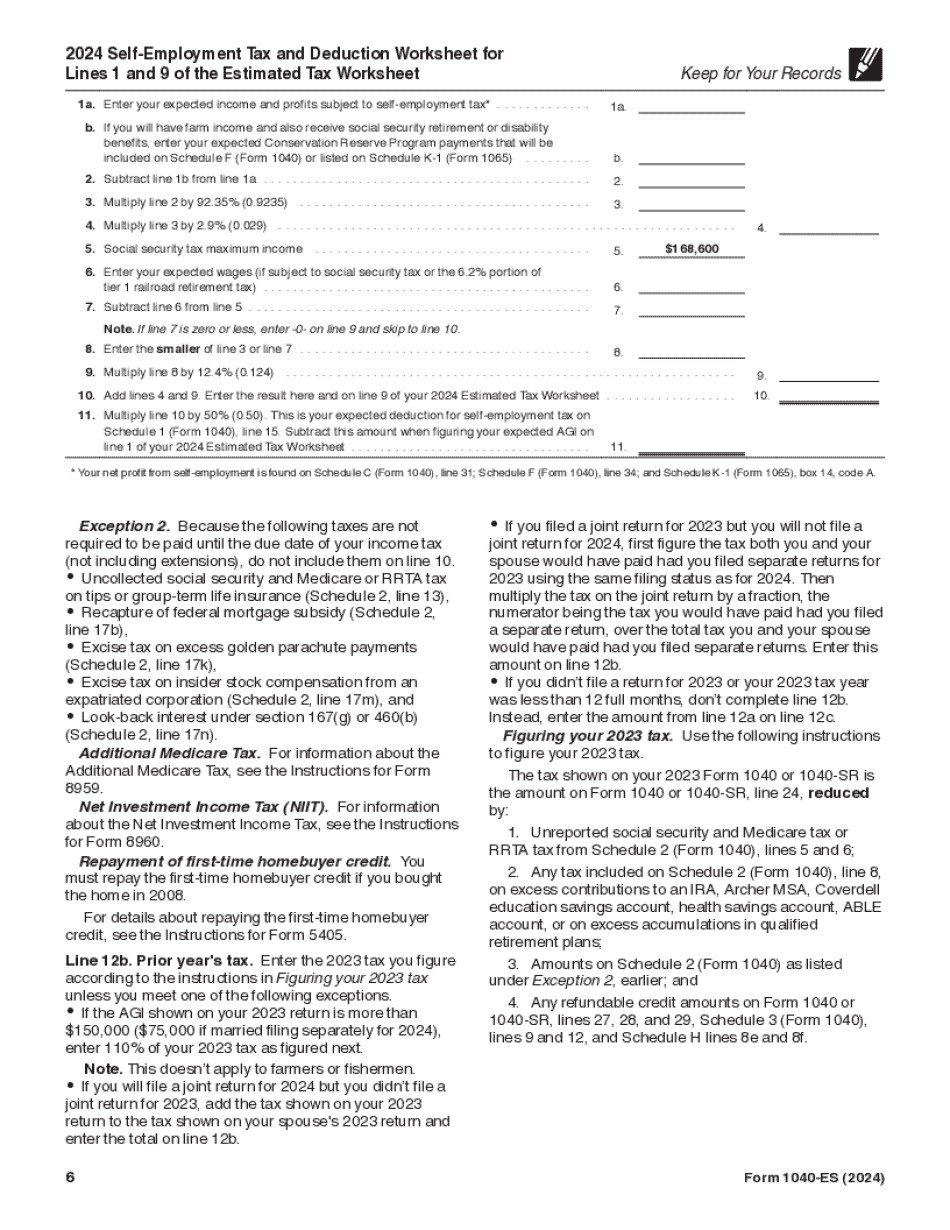

Video instructions and help with filling out and completing Form 1040-ES vs. Form 1040 Schedule C