Hello friends welcome back to another money minute with Bonita Tyler aka woman CFO, so I'm answering another tax question from those of you who are in the thrust of filing your income tax returns this year I know that some of the forms that are coming through seem foreign many of you guys are especially if you're here in testate of Michigan receiving these form sin the mail I'm coming to try to zoom inhere so that you can see it but this San individual estimated income tax voucher and what this voucher is testate's way of saying or your local governments way of saying hey we want you to pay your taxes before you file next year, so you have four coupons and'm going to explain some things that are on this form here at the bottoms here at the bottom here you'll seethe date that this estimated tax payments due you have four of these coupons you're going to have due dates that argue in April June September and the last payment will be due next year in January and what these tax vouchers help you to-do is get ahead of the tax liability or the bill that you may have to pay so what people ask me all the time is well how much money do I send these people you know do I send to state or do I send the IRS for example because you may even have these vouchers from the IRS if you owe taxes last year what you do is you look at how much you had to pay in the previous tax period last year for example if you old $7,000 and your income is about the same then you'redoing to be dividing that $7,000 into four equal installments that...

Award-winning PDF software

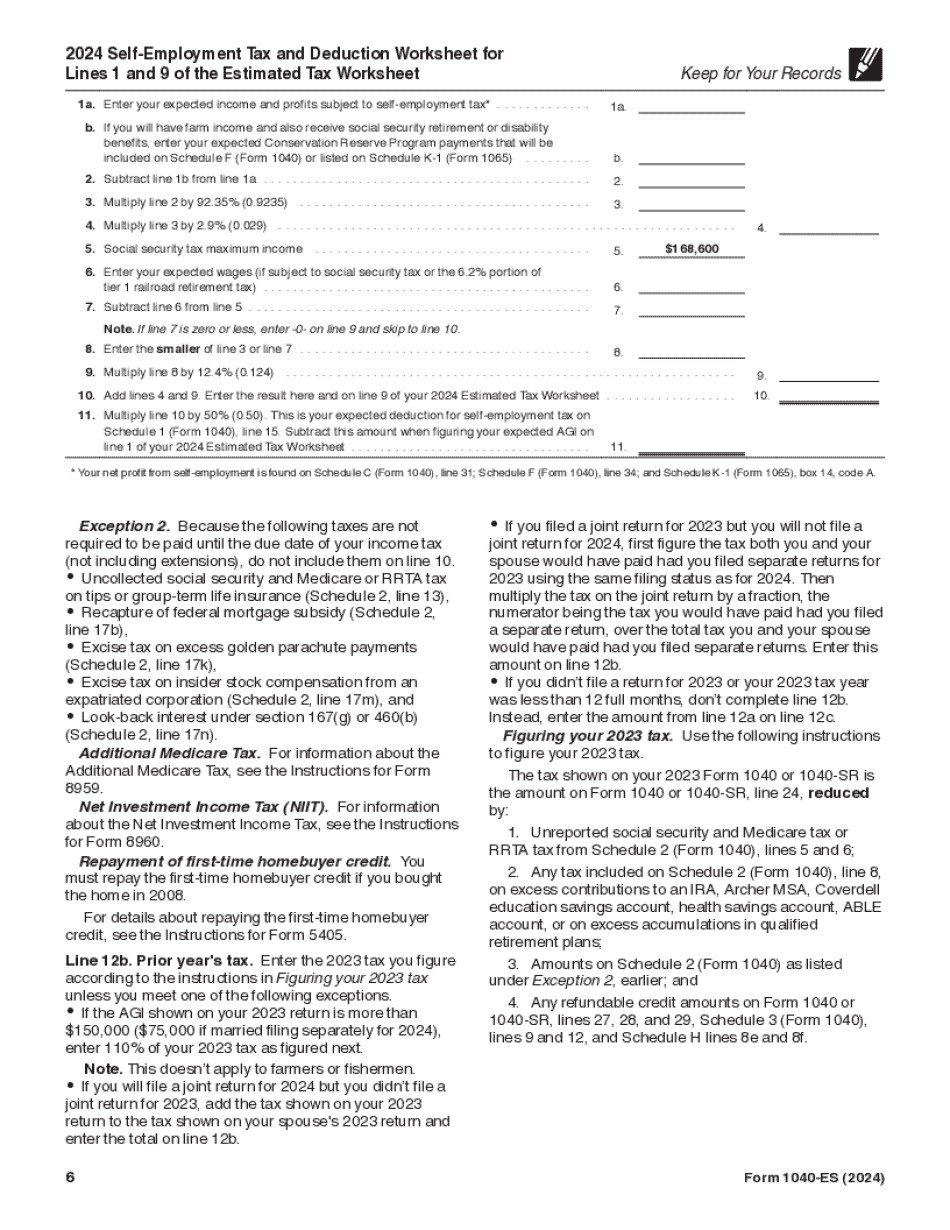

How to prepare Form 1040-ES

About Form 1040-ES

Form 1040-ES is a payment voucher used to make estimated tax payments throughout the year. It is primarily used by self-employed individuals, freelancers, and those who receive income that is not subject to withholding (such as rental income or capital gains). The purpose of the form is to help individuals avoid underpaying their taxes, which can result in penalties and interest charges. The 1040-ES form is used to calculate and make quarterly payments of estimated taxes for the current tax year.

What Is 1040 Es IRS form?

Online technologies allow you to organize your document management and improve the efficiency of the workflow. Follow the brief information in an effort to complete IRS 1040 BS IRS form, prevent mistakes and furnish it in a timely way:

How to fill out a printable form 1040 BS payment voucher?

-

On the website with the form, click on Start Now and pass for the editor.

-

Use the clues to complete the appropriate fields.

-

Include your personal data and contact information.

-

Make certain that you enter correct details and numbers in suitable fields.

-

Carefully verify the information of your document so as grammar and spelling.

-

Refer to Help section should you have any concerns or contact our Support team.

-

Put an digital signature on your 1040 BS tax form printable while using the support of Sign Tool.

-

Once the form is completed, press Done.

-

Distribute the ready by means of email or fax, print it out or save on your gadget.

PDF editor enables you to make adjustments to your 1040 BS tax form Fill Online from any internet connected device, personalize it based on your needs, sign it electronically and distribute in different ways.

What people say about us

How to fix errors made in the form

Video instructions and help with filling out and completing Form 1040-ES